top of page

Death of Proprietary Platforms: How to Build AI Trading Bot Python for IBKR

. If you wanted to automate your trading, you had to master MQL5 for MetaTrader or Pine Script for TradingView. If you wanted to switch brokers, you had to rewrite your entire life's work.

Bryan Downing

3 days ago11 min read

iNTERNAL MEMORANDUM: GLOBAL MACRO & DERIVATIVES STRATEGY

Desk: Quantitative Derivatives & Global Macro

Subject: The Volatility Paradox: Alpha Generation in a Dislocated Regime Security Level: L3 (Proprietary) Derivatives Strategy

Bryan Downing

Jan 3111 min read

Max View: The Comprehensive Evolution of AI-Driven Automated Futures and Options Trading Systems

This article provides a "Max View" deep dive into a complete ecosystem designed by Brian from QuantLabsNet. This system integrates high-frequency data, advanced C# infrastructure, and the cutting-edge capabilities of AI-Driven Automated Futures and Options Trading

Bryan Downing

Jan 2911 min read

The Great Retail Pivot: Navigating the Commodity Super Cycle and the Death of Retail HFT

Date: January 27, 2026

Topic: Market Analysis, Algorithmic Trading Strategy, Commodities, Forex, and Crypto

Executive Summary

As we stand on January 27, 2026, the financial landscape has undergone a radical transformation. The strategies that defined the early 2020s are no longer sufficient. We are witnessing a convergence of extreme volatility, a historic commodity super cycle, and a fundamental shift in how retail traders must approach the markets to survive.

This report

Bryan Downing

Jan 2711 min read

The Architecture of Alpha with a Micro Futures Markets Algo Strategy

oin (MBT), Micro Crude Oil (MCL), Micro Gold (MGC), Micro S&P 500 (MES), Micro Ether (MET), Micro Nasdaq (MNQ), and Micro Silver (SIL). ). The following summarizes micro futures markets algo strategy.

Bryan Downing

Jan 1511 min read

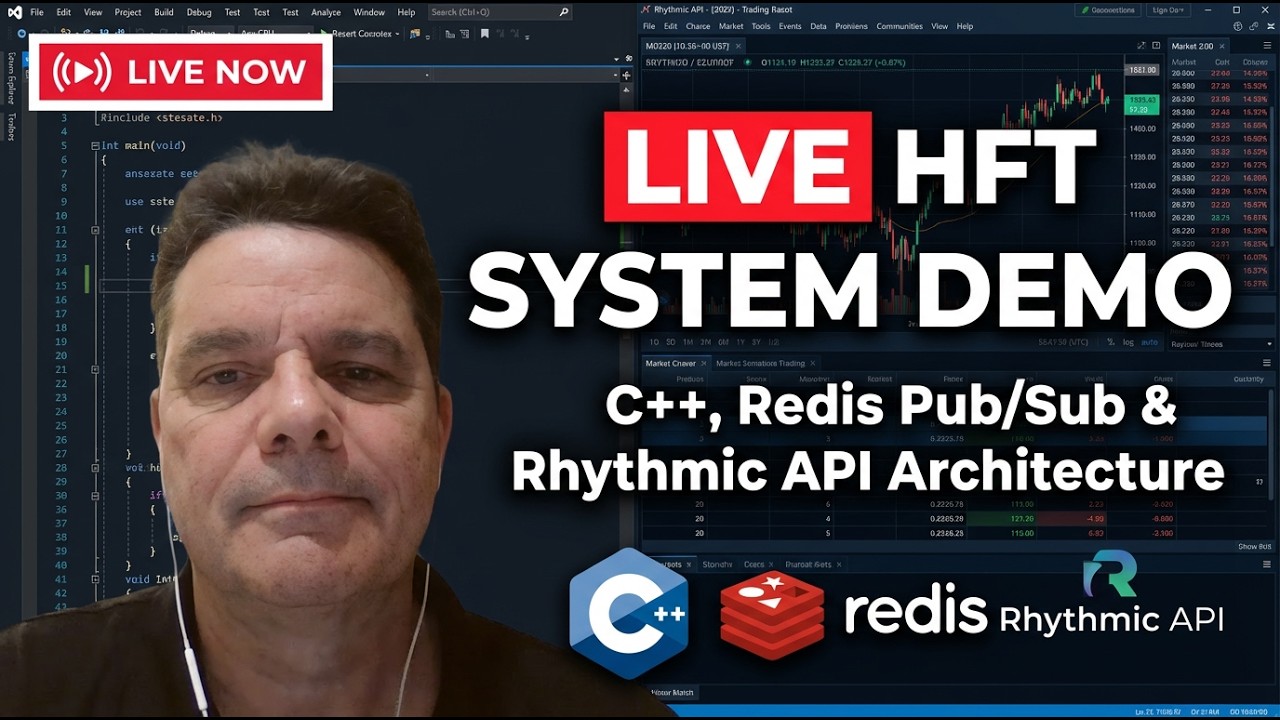

Building a High-Frequency Trading Architecture: A Deep Dive into C++, Redis Pub/Sub, and Rithmic API Integration

In the rapidly evolving world of algorithmic trading, the difference between profit and loss often comes down to microseconds. For quantitative developers and independent traders, the quest to build a robust, ultra-low latency High-Frequency trading architecture infrastructure is a continuous journey of optimization, architectural refinement, and technological integration. This article provides an extensive walkthrough of a "Science Server Edition" trading system. Based on

Bryan Downing

Jan 1412 min read

From Python Prototype to C++ Powerhouse: Mastering Institutional Bitcoin HFT & Ultra-Low Latency Market Making

The Institutional Edge: How to Build Ultra-Low Latency HFT Systems from Scratch (AI, C++, and Quant Math)

Bryan Downing

Jan 1211 min read

Building an Ultra-Low Latency Bitcoin Market Maker: A Complete Guide from AI Quant Research to C++ Execution

AI quant research, Python backtesting, and the ultimate deployment of a C++ Ultra-Low Latency Market Making strategy.

Bryan Downing

Jan 57 min read

Building a Real-Time Ethereum Futures Trading Simulator with Hurst Exponent Analysis

This isn't merely an academic exercise—it's a professional-grade simulation environment that models real market behavior, implements advanced statistical analysis, manages positions with institutional rigor, and provides comprehensive performance analytics.

Bryan Downing

Dec 9, 202522 min read

Deconstructing an Advanced Ether High Frequency Trading Bot: A C++ Breakdown

We will deconstruct the architecture of a sophisticated Ether high frequency trading bot strategy simulator written in C++

Bryan Downing

Dec 4, 20256 min read

Advanced Quantitative Strategies in High Frequency Trading Hidden Markov Models and Order Flow Toxicity Detection

We present novel approaches, including latent liquidity modeling, Bayesian toxicity scoring, and reinforcement learning-enhanced high frequency trading Hidden Markviol Models (HMMs), which remain largely undocumented in public literature.

Bryan Downing

Dec 4, 20253 min read

High-Frequency Trading (HFT) and Unknown Quantitative Analysis Techniques in Ethereum Markets

In the context of Ethereum Markets (ETH) and other cryptocurrencies, HFT strategies are increasingly sophisticated, often employing proprietary and undisclosed quantitative models

Bryan Downing

Dec 4, 20253 min read

Understanding Rithmic API's Focus on Regulated Futures Markets: Why Spot Trading Crypto Data Remains Outside Its Scope

Understanding Rithmic API's Focus on Regulated Futures Markets: Why Spot Trading Crypto Data Remains Outside Its Scope

Introduction: The Specialized World of Financial Market Data

Bryan Downing

Nov 3, 20257 min read

Revolution in Quant AITrading with Next-Generation Market Analysis

In the world of quant AI finance, the only constant is change. The relentless pursuit of an edge, however fleeting, has driven innovation at a breathtaking pace for decades.

Bryan Downing

Oct 15, 202519 min read

The Algorithmic Arms Race: An Insider's Guide to Surviving to Where the Stock Market is a Rigged

For the average retail investor, the stock market is often presented as a meritocracy of ideas—a grand arena where the best analysis and the most disciplined strategies win the day.

Bryan Downing

Sep 20, 202515 min read

Institutional Playbook: How High-Frequency Trading Firms Dominate Bitcoin Markets

This article delves deep into the institutional playbook, exposing the mechanisms these entities use to control Bitcoin markets and how retail traders often become the "liquidity" that institutions harvest.

Bryan Downing

Sep 16, 20256 min read

Quant AI Coder's Odyssey: Building a High-Frequency Bitcoin Trading Simulator in C++

Introduction: The Convergence of Quant AI Finance, and Modern Development Tools

Bryan Downing

Sep 16, 20259 min read

Quant AI-Trading: From In-Depth Analysis to Automated Strategy Execution

ion of a presentation delivered by Brian from quantlabset.com at Moomoo Financial Canada. The original event, hosted for his meetup groups, delved into the cutting-edge intersection of artificial intelligence and quant AI trading. This article aims to reconstruct that presentation,

Bryan Downing

Jul 30, 202513 min read

Mastering Market Dynamics: Strategic Blueprint for Futures and Options Trading

We will dissect the key metrics that signal opportunity, select prime candidates for our trading focus, and lay out detailed strategic plans for each.

Bryan Downing

Jun 12, 20259 min read

I Built the Ultimate AI Tools for Crypto Arbitrage Trading (Real Data)

On June 12th, a new frontier was unveiled—a system that represents the culmination of this evolution, demonstrating the incredible power of modern AI tools for crypto arbitrage trading with HFT market making. T

Bryan Downing

Jun 12, 202510 min read

bottom of page