top of page

The Algorithmic Roundtable: AI, Microstructure, and the Reality of Modern Quant Trading

We are moving from the era of manual C++ coding and standard technical indicators into a brave new world of "Vibe Coding," geopolitical AI model arbitrage, and the persistent, unglamorous grind of market microstructure.

Bryan Downing

Feb 1810 min read

The Geometry of Memory: How the Solution to a Notorious Random Walk Problem Redefines Market Alpha

For decades, the "Random Walk" has been the bedrock of financial modeling, underpinning everything from the Black-Scholes equation to the Efficient Market Hypothesis (EMH). However, a persistent open problem in mathematics has clouded our understanding of stochastic processes: Why do some random walks revert to the mean (forgetting their history), while others diverge indefinitely (remembering their path)?

Bryan Downing

Feb 188 min read

How to Set Up Algorithmic Trading with Interactive Brokers and Open Source Python

What was once the exclusive domain of hedge funds and institutional trading desks can now be explored from your home computer using free, open-source tools and a demo brokerage account.

Bryan Downing

Feb 1318 min read

The Algorithmic Democratization: How AI and Open Source Are Shattering the Walls of High-Frequency Trading

For the longest time, building your own trading bot felt like a super complex, super expensive dream. It was the realm of quantitative analysts with PhDs in mathematics, working in glass towers, utilizing infrastructure that cost millions of dollars. For the average person, the idea of automated trading was science fiction.

Bryan Downing

Feb 1312 min read

The End of Proprietary Platforms: How AI and Python Are Revolutionizing Algorithmic Trading for Beginners

Building Bots – Speed and Customization to Start Revolutionizing Algorithmic Trading for Beginners

Bryan Downing

Feb 128 min read

15 High-Conviction Trading Strategies for 2026 The Ultimate Multi-Asset Guide

For traders and investors, this environment offers a rare window of opportunity—provided they know where to look.

Bryan Downing

Feb 129 min read

Algorithmic Futures and Options Trading Strategies

The financial markets are currently perched on a precipice. With major indices showing fragility, tech giants like Microsoft dragging down sentiment, and geopolitical tensions simmering, the era of "easy money" for retail traders is over

Bryan Downing

Jan 307 min read

Max View: The Comprehensive Evolution of AI-Driven Automated Futures and Options Trading Systems

This article provides a "Max View" deep dive into a complete ecosystem designed by Brian from QuantLabsNet. This system integrates high-frequency data, advanced C# infrastructure, and the cutting-edge capabilities of AI-Driven Automated Futures and Options Trading

Bryan Downing

Jan 2911 min read

Architecting Highspeed Trading Systems: Why I Ditched C++ for C# and Pivoted to Strategy-First Design (Lessons Learned)

A deep dive into the architecture of modern highspeed trading systems. Learn why a major pivot from instrument-based to strategy-based client design changes everything, and read the brutally honest reasons why C++ on Windows failed, leading to a pragmatic, scalable solution using C# and Redis

Bryan Downing

Jan 179 min read

From Python Prototype to C++ Powerhouse: Mastering Institutional Bitcoin HFT & Ultra-Low Latency Market Making

The Institutional Edge: How to Build Ultra-Low Latency HFT Systems from Scratch (AI, C++, and Quant Math)

Bryan Downing

Jan 1211 min read

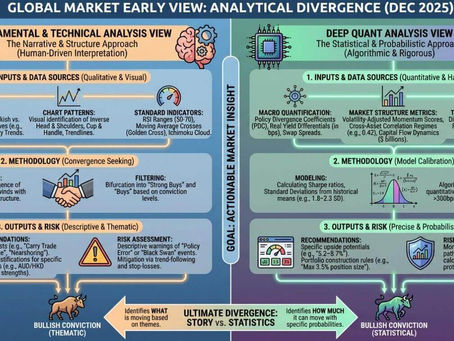

Comparative Analysis of Narrative vs. Numerical Market Forecasting for 2026

The synchronized global growth of the early 2020s is a distant memory, replaced by a fragmented, multi-speed global economy defined by extreme divergence in monetary policy, the maturation of the artificial intelligence industrial revolution, and a commodity super-cycle driven by the green energy transition. This is all about numerical market forcasting in 2026.

Bryan Downing

Dec 31, 202510 min read

AI Generated Financial Dashboards: A Comparative Analysis of Gemini 3, Claude 4.1, and Claude 4.5 Opus

Today, as evidenced by recent demonstrations in the quantitative trading community, the paradigm has shifted.

Bryan Downing

Dec 26, 202514 min read

Launching a Professional-Grade Futures Trading Platform with Rithmic API Integration

After months of rigorous backtesting, parameter optimization, and simulated execution in controlled environments, we stand at the threshold of a significant milestone: the deployment of a live futures trading platform infrastructure powered by the Rithmic API

Bryan Downing

Dec 18, 202512 min read

The Rithmic Breakthrough: A Deep Dive into High-Frequency Trading Infrastructure, API Constraints, and the Future of Quant Development

Rithmic API using .NET/C#, capable of handling Level 2 order book data and complex execution strategies.

Bryan Downing

Dec 12, 202513 min read

High-Frequency Trading (HFT) and Unknown Quantitative Analysis Techniques in Ethereum Markets

In the context of Ethereum Markets (ETH) and other cryptocurrencies, HFT strategies are increasingly sophisticated, often employing proprietary and undisclosed quantitative models

Bryan Downing

Dec 4, 20253 min read

Comprehensive White Paper on the Structural Incompatibility Between Rithmic Infrastructure and Modern Trade Verification Systems

The Technical Impossibility of "Verified" Rithmic Futures & Options Trade Verification Journaling

Bryan Downing

Nov 25, 202510 min read

Challenging a AI Skeptic: A Look Inside a Powerful AI-Generated Trading Dashboard

In a direct message to the "haters and people that doubt to become AI skeptic," quantitative trading expert Bryan from QuantLabsNet.comargues that skepticism often stems from a lack of meaningful investment in the technology.

Bryan Downing

Oct 17, 20254 min read

Revolution in Quant AITrading with Next-Generation Market Analysis

In the world of quant AI finance, the only constant is change. The relentless pursuit of an edge, however fleeting, has driven innovation at a breathtaking pace for decades.

Bryan Downing

Oct 15, 202519 min read

The Algorithmic Arms Race: An Insider's Guide to Surviving to Where the Stock Market is a Rigged

For the average retail investor, the stock market is often presented as a meritocracy of ideas—a grand arena where the best analysis and the most disciplined strategies win the day.

Bryan Downing

Sep 20, 202515 min read

Your Path to One of the Best Quant Finance Programs: Quant Analytics is Merging into the Premier Quant Elite Membership This Labor Day, Sept 1st.

A Pivotal Moment for Your Algorithmic Trading Career via Best Quant Finance Programs

Bryan Downing

Aug 26, 20259 min read

bottom of page