top of page

Comprehensive Quantitative Analysis of CME Futures Trading Strategies: A 30-Hour Live Market Session Study

The findings of these CME Futures Trading Strategies reveal significant disparities in execution efficiency, signal extraction methodologies, and market regime adaptation that carry substantial implications for strategy deployment, risk management, and infrastructure investment decisions.

Bryan Downing

Jan 2812 min read

The Great Retail Pivot: Navigating the Commodity Super Cycle and the Death of Retail HFT

Date: January 27, 2026

Topic: Market Analysis, Algorithmic Trading Strategy, Commodities, Forex, and Crypto

Executive Summary

As we stand on January 27, 2026, the financial landscape has undergone a radical transformation. The strategies that defined the early 2020s are no longer sufficient. We are witnessing a convergence of extreme volatility, a historic commodity super cycle, and a fundamental shift in how retail traders must approach the markets to survive.

This report

Bryan Downing

Jan 2711 min read

The Invisible War: Decoding Data, Noise, and the Future of Algo Trading in 2026

Introduction: The Boring Truth Behind the Bells and Whistles It is the evening of January 24, 2026. The markets have closed, the noise of the opening bell has long faded, and the retail public has largely turned its attention away from the charts. However, for a select few—the quantitative analysts, the algorithmic developers, and the high-frequency trading (HFT) firms—the work is just beginning. In the world of modern finance, there is a pervasive myth that successful tradi

Bryan Downing

Jan 2411 min read

The "Great Pivot" in HFT Architecture: Why Strategy Beats Raw Speed in C# vs C++ for trading systems

In the world of High-Frequency Trading (HFT) and algorithmic execution, there is a pervasive myth that refuses to die: "If it isn't C++, it isn't real trading."

Bryan Downing

Jan 217 min read

Architecting Highspeed Trading Systems: Why I Ditched C++ for C# and Pivoted to Strategy-First Design (Lessons Learned)

A deep dive into the architecture of modern highspeed trading systems. Learn why a major pivot from instrument-based to strategy-based client design changes everything, and read the brutally honest reasons why C++ on Windows failed, leading to a pragmatic, scalable solution using C# and Redis

Bryan Downing

Jan 179 min read

The Architecture of Alpha with a Micro Futures Markets Algo Strategy

oin (MBT), Micro Crude Oil (MCL), Micro Gold (MGC), Micro S&P 500 (MES), Micro Ether (MET), Micro Nasdaq (MNQ), and Micro Silver (SIL). ). The following summarizes micro futures markets algo strategy.

Bryan Downing

Jan 1511 min read

Building a High-Frequency Trading Architecture: A Deep Dive into C++, Redis Pub/Sub, and Rithmic API Integration

In the rapidly evolving world of algorithmic trading, the difference between profit and loss often comes down to microseconds. For quantitative developers and independent traders, the quest to build a robust, ultra-low latency High-Frequency trading architecture infrastructure is a continuous journey of optimization, architectural refinement, and technological integration. This article provides an extensive walkthrough of a "Science Server Edition" trading system. Based on

Bryan Downing

Jan 1412 min read

From Python Prototype to C++ Powerhouse: Mastering Institutional Bitcoin HFT & Ultra-Low Latency Market Making

The Institutional Edge: How to Build Ultra-Low Latency HFT Systems from Scratch (AI, C++, and Quant Math)

Bryan Downing

Jan 1211 min read

The Nanosecond Frontier: Institutional HFT Architecture for the Retail Quant

Is it possible to bridge the gap between a retail laptop and a Citadel-style i

trading rig for the price of a steak dinner? A new course claims to hand over the keys to the kingdom of C++20, Avellaneda-Stoikov, and AI-driven market making.

Bryan Downing

Jan 712 min read

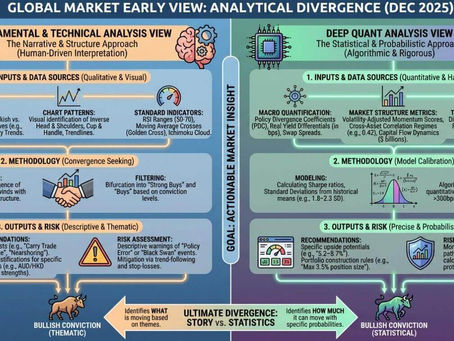

Comparative Analysis of Narrative vs. Numerical Market Forecasting for 2026

The synchronized global growth of the early 2020s is a distant memory, replaced by a fragmented, multi-speed global economy defined by extreme divergence in monetary policy, the maturation of the artificial intelligence industrial revolution, and a commodity super-cycle driven by the green energy transition. This is all about numerical market forcasting in 2026.

Bryan Downing

Dec 31, 202510 min read

Modern High Frequency Trading Engine: A Comprehensive Architecture Analysis

This article provides an exhaustive analysis of a next-generation High Frequency Trading Engine (HFT) architecture.

Bryan Downing

Dec 26, 202510 min read

Building a High Frequency Trading Engine: A Deep Dive into .NET 8, Rithmic API, and Valkey Architecture

The Rithmic High Frequency Trading Engine System is a high-performance, distributed trading infrastructure designed to bridge the gap between the Rithmic RAPI (a C++ based API with a .NET wrapper used for futures trading) and modern, custom algorithmic strategies.

Bryan Downing

Dec 23, 20259 min read

What Is a Rithmic API Conformance Test?

Before a trading application is allowed to connect to live markets through Rithmic, it must typically pass a Rithmic API conformance test.

Bryan Downing

Dec 19, 20257 min read

From Futures to Options: A Deep Dive into Algorithmic Trading Strategies and Practical Starting Points

A recent YouTube live stream tackled this challenge head-on, offering a masterclass that masterfully connected the dots between granular futures data, sophisticated options algorithmic trading strategies, and high-level, automated trade discovery.

Bryan Downing

Dec 19, 202521 min read

Launching a Professional-Grade Futures Trading Platform with Rithmic API Integration

After months of rigorous backtesting, parameter optimization, and simulated execution in controlled environments, we stand at the threshold of a significant milestone: the deployment of a live futures trading platform infrastructure powered by the Rithmic API

Bryan Downing

Dec 18, 202512 min read

The Rithmic Breakthrough: A Deep Dive into High-Frequency Trading Infrastructure, API Constraints, and the Future of Quant Development

Rithmic API using .NET/C#, capable of handling Level 2 order book data and complex execution strategies.

Bryan Downing

Dec 12, 202513 min read

AI Quant Revolution: From PDF to C++ High-Frequency Trading Bot in a Single Workflow

For decades, the world of quantitative finance, particularly C++ high-frequency trading bot, has been an exclusive club. It was the domain of elite QI quant institutions with cavernous server rooms, teams of PhDs in physics and mathematics, and budgets stretching into the millions.

Bryan Downing

Dec 5, 202513 min read

Advanced Quantitative Strategies in High Frequency Trading Hidden Markov Models and Order Flow Toxicity Detection

We present novel approaches, including latent liquidity modeling, Bayesian toxicity scoring, and reinforcement learning-enhanced high frequency trading Hidden Markviol Models (HMMs), which remain largely undocumented in public literature.

Bryan Downing

Dec 4, 20253 min read

Unstoppable Ascent: Gold and Silver Rally on Strong Global Market Sentiment

The timeless allure of a gold and silver rally has once again captured the global spotlight, as these precious metals embark on a remarkable rally, fueled by a potent cocktail of strong global market sentiment.

Bryan Downing

Nov 30, 202514 min read

High-Frequency Frontier: A Deep Dive into Order Books, AI, and the Future of quantitative trading

his article will meticulously unpack Bryan's insights, expanding on the technical underpinnings, strategic implications, and the future trajectory of quantative trading as envisioned by QuantLabs.net.

Bryan Downing

Nov 29, 202514 min read

bottom of page