top of page

The Invisible War: Decoding Data, Noise, and the Future of Algo Trading in 2026

Introduction: The Boring Truth Behind the Bells and Whistles It is the evening of January 24, 2026. The markets have closed, the noise of the opening bell has long faded, and the retail public has largely turned its attention away from the charts. However, for a select few—the quantitative analysts, the algorithmic developers, and the high-frequency trading (HFT) firms—the work is just beginning. In the world of modern finance, there is a pervasive myth that successful tradi

Bryan Downing

Jan 2411 min read

Building a High-Speed AI Trading System in C#: A Live Look at NQ, ES, and Oil Strategies

If you have been following my journey at QuantLabsNet, you know that the pursuit of the ultimate trading infrastructure is a never-ending process of refinement, testing, and coding. But recently, we have crossed a major threshold.

Bryan Downing

Jan 2210 min read

Building a High-Speed Futures Trading System with C# and AI: The 2026 Architecture Guide

Gone are the days when high-frequency trading (HFT) was solely the domain of C++ wizards in Chicago basements. Today, thanks to advancements in .NET performance and the explosive capabilities of AI coding assistants, building a robust, multi-strategy engine is more accessible than ever.

Bryan Downing

Jan 2211 min read

The "Great Pivot" in HFT Architecture: Why Strategy Beats Raw Speed in C# vs C++ for trading systems

In the world of High-Frequency Trading (HFT) and algorithmic execution, there is a pervasive myth that refuses to die: "If it isn't C++, it isn't real trading."

Bryan Downing

Jan 217 min read

Architecting Highspeed Trading Systems: Why I Ditched C++ for C# and Pivoted to Strategy-First Design (Lessons Learned)

A deep dive into the architecture of modern highspeed trading systems. Learn why a major pivot from instrument-based to strategy-based client design changes everything, and read the brutally honest reasons why C++ on Windows failed, leading to a pragmatic, scalable solution using C# and Redis

Bryan Downing

Jan 179 min read

The Architecture of Alpha with a Micro Futures Markets Algo Strategy

oin (MBT), Micro Crude Oil (MCL), Micro Gold (MGC), Micro S&P 500 (MES), Micro Ether (MET), Micro Nasdaq (MNQ), and Micro Silver (SIL). ). The following summarizes micro futures markets algo strategy.

Bryan Downing

Jan 1511 min read

The Architecture of Alpha: A Comprehensive Guide to Micro Futures and Automated Strategy Implementation

The retail trader, often limited to the equity or spot Forex markets, was effectively priced out of the liquidity and transparency offered by the central exchanges like the Chicago Mercantile Exchange (CME). These all use any of the automated strategy implementation listed below.

Bryan Downing

Jan 1517 min read

Building a High-Frequency Trading Architecture: A Deep Dive into C++, Redis Pub/Sub, and Rithmic API Integration

In the rapidly evolving world of algorithmic trading, the difference between profit and loss often comes down to microseconds. For quantitative developers and independent traders, the quest to build a robust, ultra-low latency High-Frequency trading architecture infrastructure is a continuous journey of optimization, architectural refinement, and technological integration. This article provides an extensive walkthrough of a "Science Server Edition" trading system. Based on

Bryan Downing

Jan 1412 min read

From Python Prototype to C++ Powerhouse: Mastering Institutional Bitcoin HFT & Ultra-Low Latency Market Making

The Institutional Edge: How to Build Ultra-Low Latency HFT Systems from Scratch (AI, C++, and Quant Math)

Bryan Downing

Jan 1211 min read

The Nanosecond Frontier: Institutional HFT Architecture for the Retail Quant

Is it possible to bridge the gap between a retail laptop and a Citadel-style i

trading rig for the price of a steak dinner? A new course claims to hand over the keys to the kingdom of C++20, Avellaneda-Stoikov, and AI-driven market making.

Bryan Downing

Jan 712 min read

Building an Ultra-Low Latency Bitcoin Market Maker: A Complete Guide from AI Quant Research to C++ Execution

AI quant research, Python backtesting, and the ultimate deployment of a C++ Ultra-Low Latency Market Making strategy.

Bryan Downing

Jan 57 min read

Ultra Low Latency High Frequency Market Making: A Comprehensive Analysis of the Avellaneda-Stoikov Framework with Order Flow Imbalance Enhancement

This article presents an exhaustive examination of an institutional-grade market making system that combines the seminal Avellaneda-Stoikov optimal market making model with Order Flow Imbalance signals to achieve consistent risk-adjusted returns while maintaining sub-microsecond processing latencies.

Bryan Downing

Jan 320 min read

Designing and Implementing a High-Performance Trading Gateway: A Comprehensive Architectural Overview

In summary, this is a high-performance trading gateway using Futures and options for HFT with C++ in VS Code with live Rithmic data.

Bryan Downing

Jan 216 min read

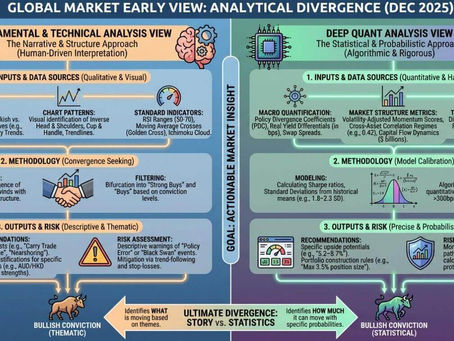

Comparative Analysis of Narrative vs. Numerical Market Forecasting for 2026

The synchronized global growth of the early 2020s is a distant memory, replaced by a fragmented, multi-speed global economy defined by extreme divergence in monetary policy, the maturation of the artificial intelligence industrial revolution, and a commodity super-cycle driven by the green energy transition. This is all about numerical market forcasting in 2026.

Bryan Downing

Dec 31, 202510 min read

Kernel Bypass Networking for Ultra-Low Latency HFT Systems

Kernel bypass technologies eliminate these bottlenecks by allowing applications to directly access NIC hardware, reducing latency to <1µs in optimized setups.

Bryan Downing

Dec 29, 20258 min read

Ultra Low Latency Market Making System for HFT (C++)

Below is a conceptual framework for an ultra low latency market making system combining futures and options. This is a simplified version that would need significant customization for a billion-dollar HFT firm.

Bryan Downing

Dec 29, 20257 min read

Modern High Frequency Trading Engine: A Comprehensive Architecture Analysis

This article provides an exhaustive analysis of a next-generation High Frequency Trading Engine (HFT) architecture.

Bryan Downing

Dec 26, 202510 min read

AI Generated Financial Dashboards: A Comparative Analysis of Gemini 3, Claude 4.1, and Claude 4.5 Opus

Today, as evidenced by recent demonstrations in the quantitative trading community, the paradigm has shifted.

Bryan Downing

Dec 26, 202514 min read

Building a High Frequency Trading Engine: A Deep Dive into .NET 8, Rithmic API, and Valkey Architecture

The Rithmic High Frequency Trading Engine System is a high-performance, distributed trading infrastructure designed to bridge the gap between the Rithmic RAPI (a C++ based API with a .NET wrapper used for futures trading) and modern, custom algorithmic strategies.

Bryan Downing

Dec 23, 20259 min read

How the World’s Largest High Frequency Trading Firms Shape the Global Futures Ecosystem Through Rithmic and CQG

This article identifies the largest high-frequency trading houses that simultaneously anchor both ecosystems

Bryan Downing

Dec 23, 20256 min read

bottom of page